TSX vs S&P 500: Where Should You Invest

- T.F.

- Jul 11, 2025

- 3 min read

Over the past year, the Canadian stock market has done something uncommon- it outperformed the U.S. stock market. For many investors, this might raise an important question:

Should I be investing more in Canada and less in the U.S.?

Canadians, like many non-Americans, invest a significant portion of their wealth in the US stock market. Even those fully committed to Canadian markets are more than likely indirectly exposed through their pension funds, which are typically heavily invested in U.S. markets.

So, is this recent outperformance a sign of change, or just short-term noise? Let’s dig into the data.

A Snapshot of the past year

In the past 12 months, if you invested $10,000, the Canadian stock market would have yielded about $2,100.

The US stock market would yield you about $1,100.

That’s a 21% return over the past year on the Canadian stock market represented by the TSX, and an 11% return on the U.S. stock market represented by the S&P 500.

The reason for this outperformance? The strong performance of Canada’s materials sector, driven to a large extent by a surge in the demand for Gold.

I will follow up with another blog post explaining why central banks and investors are stocking up on gold.

While Canadian investors are right to feel good about stronger TSX returns, it is crucial to zoom out for more context.

Looking back further

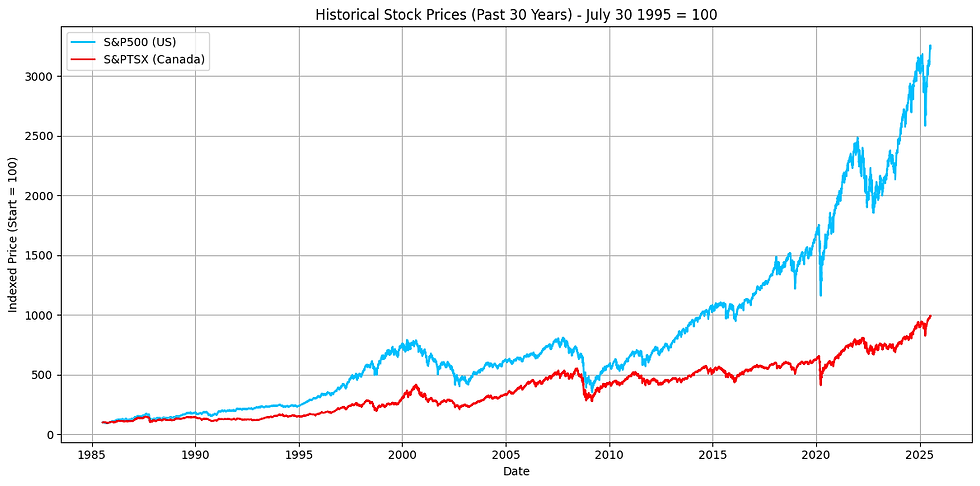

Over the past 30 years, the Canadian stock market has returned 497%, while the U.S. stock market has returned 1,052%.

Keeping things simple, $10,000 invested in 1995 would have grown to about $58,000 if invested in the TSX, compared to about $112,000 if invested in the S&P 500.

That is a difference of over $50,000. This is of course assuming no tax or exchange rate impact to keep things simple.

The difference reflects the relatively large size of U.S. companies and the strong performance of certain sectors, notably technology and financials, over the years.

Different Yet Similar

An important consideration in deciding what to invest in is how similar the investments are-, that is, how correlated their moves are. Generally speaking, the moves on the TSX generally follow the S&P 500 closely.

Over the past 30 years, the correlation between the TSX and S&P 500 has been around 0.92, or 92%.

This strong positive correlation essentially means that when the US stock market is declining, so is the Canadian stock market.

Basically, the Canadian stock market would not have added much diversification to your total portfolio if you were also invested in the US market.

Although correlation over the past year was less at 0.8 (or 80%), this is not unusual as correlations can vary significantly from year to year. In 2017 for example correlation was a mere 18%. For long term investors, long term trends ultimately matter more.

Should the Recent Shift in Trends Change Your Investment Strategy?

It really depends on what your strategy is.

Certain shifts are occurring that appear to be changing the structure of the global economy. While these will have lasting impacts, the important question is whether these changes will fundamentally affect the dominance of the U.S. stock market.

Looking at the Canada-U.S. context specifically, there is a question of whether the trade barriers that have been put up lead to a decoupling of the Canada and U.S. stock market, and to what extent.

Perhaps a topic for a future post on my substack where I cover economic developments in detail.

The Bottom Line

The moral of the story here is not to get carried away with trends. Investing requires deep thought and strategy, looking under the hood and asking the right questions.

That’s why I help my clients create customized investment strategies that align with both long-term goals and current opportunities, helping them avoid emotional decisions that could quietly cost hundreds of thousands over time.

Subscribe to my newsletter to be notified of more deep dives like this.

Comments